Is Buying Diamond Jewellery a Good Investment?

When it comes to investments, most people think of stocks, bonds, real estate, or even gold. However, for some, the idea of buying diamond jewelry as an investment may seem both appealing and glamorous. But is it a good investment? In this article, we will explore the pros and cons of investing in diamond jewelry, analyze its potential for long-term financial growth, and discuss the factors one should consider before making a purchase.

Introduction to Diamond Jewellery Investment

Diamonds have long been associated with luxury, elegance, and wealth. For centuries, they have symbolized status and power, often gifted during significant life events such as engagements and anniversaries. Yet, beyond their emotional and aesthetic appeal, diamonds are sometimes considered as a form of financial investment.

But are they as reliable as traditional assets like real estate or stocks? To answer this, we need to delve deeper into the dynamics of the diamond market and how it behaves compared to other investment avenues.

Understanding the Value of Diamonds

Unlike commodities such as gold, the value of diamonds is not determined by a standardized global price. Instead, a diamond’s value depends on several characteristics, often referred to as the “4 Cs”: Cut, Carat, Color, and Clarity. Each of these attributes plays a crucial role in determining a diamond’s price.

- Cut: Refers to how well the diamond is shaped and faceted. A better cut enhances the diamond’s brilliance and can significantly impact its value.

- Carat: This measures the diamond’s weight. Larger diamonds are rare and hence more valuable, but two diamonds of the same weight can differ in value based on other factors.

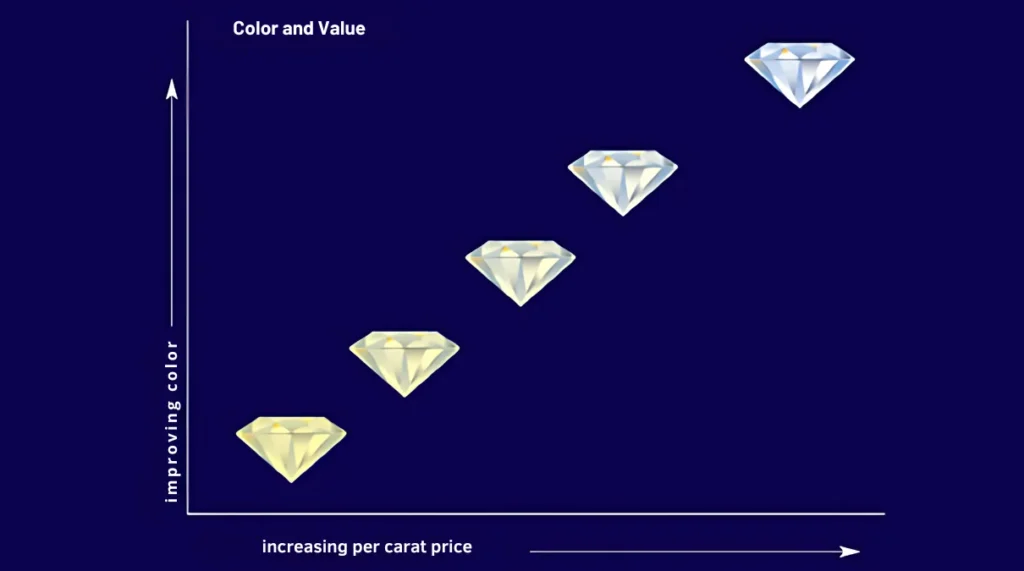

- Color: Diamonds are graded from colorless to yellow. Colorless diamonds are generally more desirable and fetch a higher price.

- Clarity: Measures the absence of inclusions or blemishes. The fewer imperfections a diamond has, the higher its value.

These factors combined determine the price of individual diamonds, making it important for potential investors to thoroughly understand the grading system before purchasing.

-

Loose Asscher Cut Diamond 1 Carat- GIA Certified₹306,240.00

Loose Asscher Cut Diamond 1 Carat- GIA Certified₹306,240.00 -

-

Pear Shaped Loose Diamond 1 Carat- GIA Certified₹451,925.00

Pear Shaped Loose Diamond 1 Carat- GIA Certified₹451,925.00 -

-

-

Loose Marqauise Diamond 1 Carat GIA Certified₹520,925.00

Loose Marqauise Diamond 1 Carat GIA Certified₹520,925.00 -

-

-

-

Factors That Affect Diamond Prices

In addition to the 4 Cs, the market price of diamonds can fluctuate based on external factors such as:

- Market Demand and Supply: The demand for diamonds can vary with economic conditions, cultural trends, and the rise of synthetic alternatives. The availability of natural diamonds is limited, but the discovery of new mines can affect prices.

- Global Economic Climate: As with any luxury good, diamonds are affected by broader economic factors. In times of economic instability, demand for luxury items like diamonds may decline, affecting their resale value.

Is Diamond Jewellery a Liquid Investment?

One important aspect of any investment is liquidity – the ease with which you can sell an asset. Diamond jewelry, unlike stocks or bonds, is not a liquid investment.

While you can sell diamonds, the process is often more complicated, involving appraisals, and there is no guarantee you will get a price close to what you initially paid. The retail markup on diamonds is usually high, meaning you may lose money if you attempt to resell them in the short term.

Historical Perspective: Do Diamonds Appreciate Over Time?

Historically, diamonds have appreciated at a slow rate, and in some cases, their prices have remained stagnant for years. Unlike gold or silver, which are actively traded commodities, diamonds do not have a universally recognized exchange or standardized pricing.

While rare and unique diamonds can see significant appreciation, this is not the norm for most stones, especially if purchased as jewelry rather than loose diamonds.

Comparing Diamonds with Traditional Investments

Diamonds vs. Gold

Gold is often seen as a “safe haven” investment during times of economic uncertainty because it holds intrinsic value and is widely recognized as a store of wealth. Diamonds, on the other hand, are considered luxury items, and their value is more subjective. While both are tangible assets, gold tends to be more liquid and has a more consistent track record of appreciation.

Diamonds vs. Stocks and Bonds

Unlike stocks and bonds, which can generate income through dividends or interest, diamonds do not produce any regular returns. They are a form of speculative investment, with their value depending solely on market demand at the time of sale.

Pros of Investing in Diamond Jewellery

While there are risks, there are also potential advantages to investing in diamond jewelry:

- Tangibility and Aesthetic Value: Diamonds are physical assets, and unlike digital or paper investments, you can wear and enjoy them.

- Emotional and Sentimental Worth: Diamonds often carry emotional value, especially if they are part of a family heirloom. This sentimental worth can sometimes overshadow the financial return on investment.

-

14KT Gold Eternal Elegance Diamond Pendant₹47,600.00

14KT Gold Eternal Elegance Diamond Pendant₹47,600.00 -

14KT Gold & Diamond Floral Design Pendant₹38,800.00

14KT Gold & Diamond Floral Design Pendant₹38,800.00 -

14KT Gold Circles Loop Diamond Bangles₹496,200.00

14KT Gold Circles Loop Diamond Bangles₹496,200.00 -

14KT Gold Classic Diamond Halo Pendant₹76,800.00

14KT Gold Classic Diamond Halo Pendant₹76,800.00 -

14KT Gold Crystal Crest Diamond Necklace₹525,900.00

14KT Gold Crystal Crest Diamond Necklace₹525,900.00 -

-

14KT Gold Diamond Archer Pendant₹44,600.00

14KT Gold Diamond Archer Pendant₹44,600.00 -

14KT Gold Diamond Aries Zodiac Sign Bracelet₹38,652.00

14KT Gold Diamond Aries Zodiac Sign Bracelet₹38,652.00 -

14KT Gold Diamond Barb Ring₹49,000.00

14KT Gold Diamond Barb Ring₹49,000.00 -

14KT Gold Diamond Bracelet with Round Charm₹42,000.00

14KT Gold Diamond Bracelet with Round Charm₹42,000.00

Cons of Investing in Diamond Jewellery

However, investing in diamond jewelry comes with several downsides:

- High Transaction Costs: When you buy diamond jewelry, you often pay a significant markup, which includes the cost of the setting, craftsmanship, and retail expenses. This can make it difficult to recoup your investment if you sell the piece.

- Depreciation Risks: If a diamond is not of exceptionally high quality, it may not appreciate significantly, and its resale value could be lower than the original purchase price.

How to Assess the Quality of a Diamond Investment

For those seriously considering diamonds as an investment, understanding how to assess the quality is essential. Start by obtaining a diamond with certification from reputable organizations such as the Gemological Institute of America (GIA).

Consider factors like rarity, color grade, and overall market trends. It’s also important to consult with professionals before making a large investment in diamonds.

Buying Diamonds as a Hedge Against Inflation

Some investors view diamonds as a hedge against inflation, believing that they will retain their value over time as currencies fluctuate. However, the lack of standardization and the subjective nature of diamond pricing make this a less reliable strategy compared to commodities like gold.

Diamond Jewellery as a Legacy Investment

Many people buy diamond jewelry as a long-term legacy investment, intending to pass it down to future generations. In this case, the financial return may be less important than the sentimental and emotional value.

High-quality, well-maintained diamonds can indeed be treasured for decades, and their value may increase over time, especially if they become family heirlooms.

Common Myths About Diamond Investments

- “Diamonds Always Appreciate in Value”: Not all diamonds increase in value. Many may lose value when resold.

- “Bigger is Better”: A large diamond does not always equate to a better investment. Quality is often more important than size.

How to Store and Maintain Diamond Jewellery

Proper storage and maintenance are critical to preserving the value of diamond jewelry. Ensure that the pieces are stored in a dry, secure place, ideally in a soft, padded case to prevent scratches.

Regular cleaning and professional inspections can help maintain the brilliance and structural integrity of the diamond.

Expert Opinions: Is Diamond Jewellery a Good Investment?

Most financial experts agree that while diamond jewelry can be a part of a diversified investment portfolio, it should not be relied upon as a primary investment vehicle.

The high costs of buying, storing, and reselling diamonds, along with the uncertainties of market demand, make them a risky investment compared to other more liquid and income-generating assets.